Why is there a property tax rate?

Tarrant Regional Water District is tasked with providing vital flood protection that protects hundreds of thousands of lives and billions in property throughout Fort Worth. The property taxes collected allow TRWD to maintain the 27-mile federal floodway levees that stretch through much of Fort Worth.

Who sets the rate?

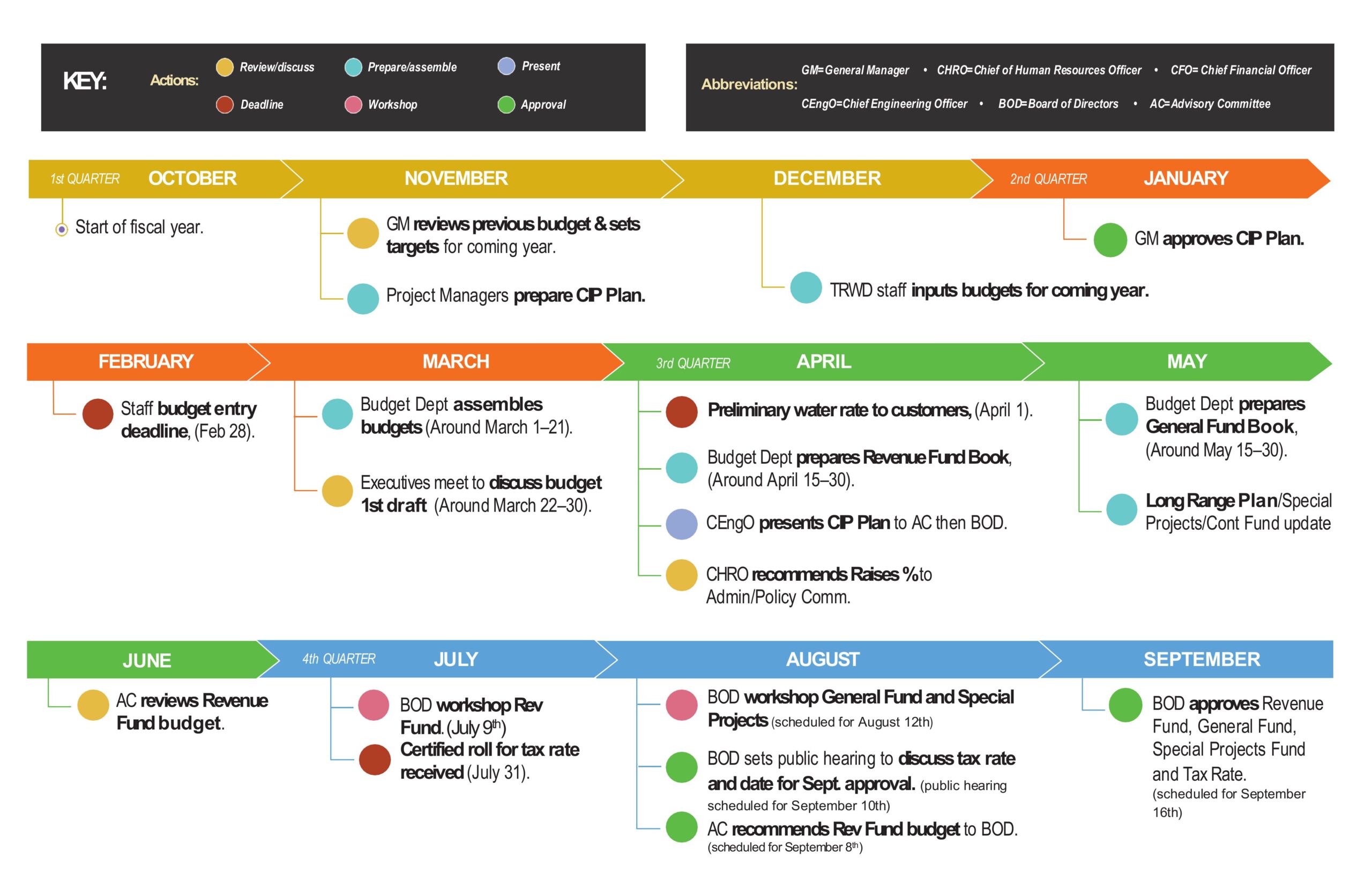

The tax rate is approved by the TRWD Board of Directors each September.

How does TRWD use these funds?

TRWD’s tax rate is used to support the District’s General Fund, which includes our flood protection and levee maintenance efforts. To see how TRWD’s other functions are funded, visit current TRWD Funding.

What is the current tax rate?

The approved 2025 tax rate is 0.0265 per $100 valuation, which is down from the 2024 rate of 0.0267.

“OK, so how does this affect me?”

TRWD’s property tax on the average residential home value in 2025 was approximately one percent of the homeowner’s total tax bill. At their September 2025 meeting, TRWD’s Board of Directors voted to adopt a tax rate at $0.0265 per $100, a slight decrease from the prior year. For the average residence, this results in a tax bill that is about 32 cents less than 2024.

THE HISTORY OF TRWD’S PROPERTY TAX RATE

For more than forty years, TRWD’s property tax rate has been one of the lowest in Tarrant County. In fact, between 1986 and 1995 the District’s tax rate was $0.00 per $100 valuation. In addition, for the last twenty-one years, it has remained between 0.200 and 0.02870 per $100 valuation.